CEU (Continuing Education Unit): 2 Credits

Educational aims and objectives

The purpose of this article is to explore some HR issues that have the potential to impact the reputation and the financial stability of your practice.

Expected outcomes

Orthodontic Practice US subscribers can answer the CE questions with the quiz to earn 2 hours of CE from reading this article. Correctly answering the questions will demonstrate the reader can:

- Recognize the benefit of an employee handbook.

- Recognize the importance of completing and maintaining proper documentation on employees.

- Identify when firing is inadvisable.

- Realize some details regarding sick leave, vacation, and final paychecks.

- Know some of the law regarding differences between employees and independent contractors.

Ali Oromchian, JD, LLM, discusses taking preventative measures to avoid costly HR issues

Many professionals like to believe that a dramatic difference exists between those who succeed in business and in life and those who fail. The truth, however, is that it is often the small things that can change a person’s success over time. Philosopher Jim Rohn explained this concept well: “Success is nothing more than a few simple disciplines, practiced every day; while failure is simply a few errors in judgment, repeated every day. It is the accumulative weight of our disciplines and our judgments that leads us to either fortune or failure.”1

As practice owners, you understand the day-to-day decisions and difficulties that can affect your practice. But how can you tell when a decision is one that can snowball into a larger problem, affecting your overall success? One solid rule of thumb is to treat all HR-related issues as serious matters, as they have the potential to impact your reputation and the financial stability of your practice. Many matters, which at first appear to be small, can quickly lead to larger problems if they are not addressed right away. This is why being proactive is so helpful for the long-term viability of your business. Many orthodontists and other medical professionals tend to overlook HR problems, believing them to affect only larger businesses. In truth, however, the majority of the HR rules that apply to a Fortune 100 company also apply to the neighborhood dental practice.

The good news is that by taking preventative measures now, you can avoid costly issues in the future. And, the new year provides a wonderful opportunity to take a “clean slate” approach towards protecting yourself and your practice. Here are 8 HR resolutions to protect your practice in 2018.

1. Updating and using your employment handbook

An up-to-date and valid employment handbook is your first line of defense in any potential employment-related litigation. Not having an employment handbook makes it easier for lawyers to bring claims of wage and hour, discrimination, retaliation, and unlawful termination. This can easily be avoided.

It is very important that you not only have a handbook, but that it has been customized for you and your practice. Your handbook can act as a valuable communication piece for both employers and employees because it defines the practice’s mission and vision, and it relays valuable information pertaining to its policies and procedures. It also communicates essential information about an employee’s benefits such as vacation, sick leave, and other state and federal laws surrounding employment. The handbook also provides guidance as to how issues should be resolved when they arise, which is especially important when defending yourself against claims of harassment and discrimination. This is why companies, such as HR for Health, provide comprehensive employment handbooks and essential annual updates to strengthen this crucial first line of defense.

2. Completing and maintaining proper documentation

As an employer, there are certain documents that you must complete and maintain for your employees. On average, there are 12 documents that each employee needs to complete, which then must be stored in a safe place. Some of the documents you need to have include: employee withholding form (W-4), Employment Eligibility Form (I-9), acknowledgment of the at-will relationship, and acknowledgement of the receipt of the employment handbook. Your state may also have its own requirements, such as a state withholding form, notice to employee regarding payment of wages, workers’ compensation brochure, and a report of new employee form.

The I-9 is worthy of focus, given that it has been recently updated by the federal government. Therefore, as you hire new employees, it is important that you provide them with that document instead of the old I-9.2 The I-9 is the document used to ensure that you are hiring someone who is authorized to work in the United States. The document must be completed by both the employer and the employee, with the employee attesting to his eligibility for employment, and the employer verifying such eligibility by reviewing documentation.

The I-9 instructions provide a list of acceptable documentation that can be used to verify identity. Note that you are not permitted to discriminate as to which documents an employee provides, as long as they are valid. The I-9 instruction form3 is very helpful and provides easy-to-follow instructions as to accepting and reviewing documentation, and completing the I-9 form itself. Follow these and all instructions completely and accurately when it comes to employment documentation to avoid future issues.

3. Understanding at-will employment and when firing is inadvisable

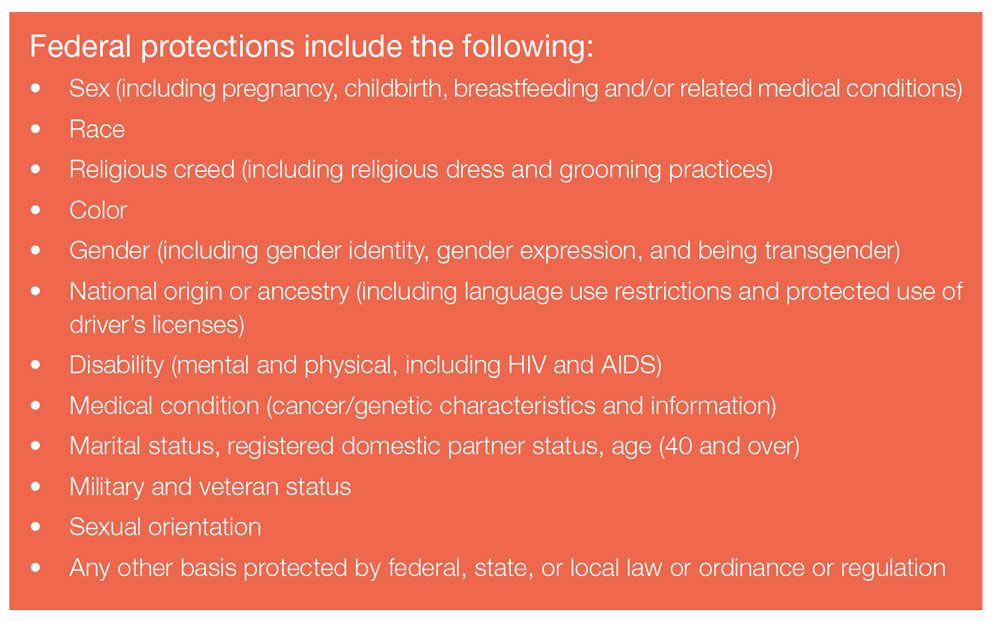

At-will employment is the most common employment categorization in the U.S., covering the vast majority of employees and terminations. This means you as an employer can terminate any of your employees without reason and without notice, and that they can quit for no reason and without notice. However, while at-will may be the rule in theory, in practice there are times when it is simply not a smart practice to fire someone. Most often, this is because your termination decision can be mistaken as one which was unlawful when the decision pertains to persons who qualify for additional protections under the law such as pregnancy, age, or disability. Therefore, you should be aware of the risks if you fire an employee under any of these three circumstances.

The first is when the employee is pregnant. The likelihood of a pregnancy discrimination lawsuit is very high when you terminate a pregnant employee. In fact, it is recommended that you keep the employee on staff during the pregnancy and during the pregnancy leave. And you should not, of course, fire the employee the day she returns from work. Instead, if termination is truly necessary, I recommend waiting at least 1 year in order for there to be no confusion as to the fact that the termination was not based upon her pregnancy, as that would be a violation of the Pregnancy Discrimination Act.4 There are exceptions, of course, such as in cases of theft or other egregious behaviors. However, if you are simply looking to take advantage of your “at-will” rights, it is advisable that you not take the risk if you can avoid it.

You should also be wary of terminating an employee who is older. We recommend that you are more careful as the employee approaches 60 years old, and that you properly document everything as you plan a termination to avoid allegations of age discrimination. Even if your reasoning for terminating the employee is justified, it is advisable that you support your decision to terminate (if you truly cannot avoid a termination), due to potential allegations of violating the Age Discrimination in Employment Act.5

Finally, you should be hesitant to fire an employee if he/she is disabled or has suffered from a workers’ compensation injury. There are many protections in place when someone has a disability or injury, and you need to be very careful before you terminate that employee as the definition of disability can vary and is typically very broad. Americans with disabilities are protected by the Americans with Disabilities Act Amendments Act of 2008 (ADAAA),6 and FMLA Regulations 825.702(c)(4) and (d)(2) address the interplay of the FMLA with workers’ compensation and the ADAAA. The bottom line of these provisions is that firing someone who is disabled and/or currently on workers’ compensation can be unlawful and, therefore, is usually not worth the risk to employers except in egregious circumstances.

4. Understanding “use it or lose it” vacation/sick leave

If you, like most medical-based employers, offer your employees vacation or sick leave, then you need to make sure that you are adhering to the law when it comes to implementing “use it or lose it” policies. In most states, the employee cannot forfeit his or her unused vacation time, as this time is akin to wages.7 You can, however, limit how vacation time can be earned and used.

Also, note that in many states and cities, employees are now entitled to sick time. In addition to knowing these laws, it is important that you review the state/local paid sick leave laws and compare them to one another because in cases of conflict, the portion of each which is most beneficial to the employee will be the rule that applies.

5. Following rules regarding final paychecks

You must ensure that you know and are following the rules in terms of providing a final paycheck. Many states have rules that require you to provide the final paycheck immediately upon termination. In some states, the final paycheck must be provided by the next payroll. Regardless of which rules are followed in your state, the best practice is to prepare for terminations in advance so that you can ensure that you are adhering to all applicable rules.

6. Knowing the law as to employees and independent contractors

The employee/independent contractor distinction is one that can get orthodontists and other dental professionals into trouble. First, understand that there are important legal differences between these two categories of workers. For employees, the practice withholds income tax, Social Security, and Medicare from wages paid. For independent contractors, the practice does not withhold taxes. Therefore, you must understand which classification your workforce falls under.

The Equal Employment Opportunity Commission (EEOC) has provided a guide to be used when determining whether someone is an employee or an independent contractor.8 Generally speaking, the more control a company exercises over how, when, where, and by whom work is performed, the more likely the worker will be considered an employee, not an independent contractor. No single factor is completely determinative of whether he/she is an employee or an IC. However, there are some factors that are used by the IRS9 in making this distinction. They fall into the following three categories:

- Behavioral: Does the practice control or have the right to control what the associate does and how the associate does his/her job?

- Financial: Are the business aspects of the associate’s position controlled by the practice? (For example: how the associate is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)

- Type of relationship: Are there written contracts or employee-type benefits such as vacation time?

7. Proper designation of employees as exempt or nonexempt

An employee’s exemption status will determine whether he/she is entitled to overtime pay for working more than 40 hours per week or 8 hours in a day (in certain states). Determining a person’s qualifications to be designated as exempt or nonexempt can be completed using rules promulgated by the Department of Labor.10 To qualify for exemption (meaning that they are not entitled to minimum wage laws or to overtime), employees generally must meet certain tests regarding their job duties, and they must be paid on a salary basis, at an annual rate of $23,660.00 or higher under federal law (with some state laws using a higher salary). While you must adhere to the Fair Labor Standards Act (FLSA), requirements regarding exempt/nonexempt status, always remember to check your state laws for guidelines that are potentially more stringent. Job titles do not determine exempt status.

Here are the exemptions under the Fair Labor Standards Act.11

Executive exemption

- The employee’s primary duty must be managing the enterprise or department.

- The employee must regularly direct the work of at least 2 or more full-time employees.

- The employee must have the authority to hire/fire other employees or the employee’s suggestions and recommendations must be given particular weight.

Administrative exemption

- The employee’s primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the practice or patients.

- There must be exercise of discretion and independent judgment with respect to matters of significance.

Professional exemption

- The employee’s primary duty must be the performance of work requiring advanced knowledge.

- The advanced knowledge must be in the field of science or learning and must be acquired by a prolonged course of specialized intellectual instruction.

8. Documentation, documentation, documentation

Our final suggestion is a rule that you should apply to HR matters in your practice across the board, regardless of how they arise. This rule is to ensure that you have reduced your risk by always creating, maintaining, and updating full documentation of HR matters pertaining to your employees. We have discussed the employment handbook and the required documents, but you must make sure that you are keeping accurate and up-to-date records. For example, you should maintain records not only related to employment terms and conditions, but also those related to disciplinary matters, days missed, and late arrivals. If this sounds like a hassle, consider that documenting such matters can save you time and stress in the event of a future discrimination allegation. In addition, you can use an electronic system similar to HR for Health to house all of your HR documents safely and to make document maintenance a much simpler process. Regardless of how you maintain your materials now, remember that an ounce of prevention now can save you major troubles in the long run. By implementing these and the other strategies above, you can ensure that 2018 will be your most successful year yet.

References

1. Rohn J. Rohn: The Formula for Success (and Failure). Success Magazine. https://www.success.com/article/rohn-the-formula-for-success-and-failure. Accessed December 26, 2017.

2. United States Citizenship and Immigration Services, I-9, Employment Eligibility Verification. https://www.uscis.gov/i-9. Accessed December 26, 2017.

3. Instructions for I-9, Employment Eligibility Verification, file:///C:/Users/sarar/Downloads/i-9instr.pdf. Accessed December 26, 2017.

4. U.S. Equal Employment Opportunity Commission, The Pregnancy Discrimination Act of 1978. https://www.eeoc.gov/laws/statutes/pregnancy.cfm. Accessed December 26, 2017.

5. U.S. Department of Labor, Age Discrimination. https://www.dol.gov/general/topic/discrimination/agedisc. Accessed December 26, 2017.

6. U.S. Equal Employment Opportunity Commission, The Americans with Disabilities Act Amendments Act of 2008. https://www.eeoc.gov/laws/statutes/adaaa_info.cfm. Accessed December 26, 2017.

7. Ballman, Donna. States With Pro-Employee Laws: No Use-It-Or-Lose-It Vacation. Lexis-Nexis® Legal Newsroom. https://www.lexisnexis.com/legalnewsroom/labor-employment/b/labor-employment-top-blogs/archive/2014/12/10/states-with-pro-employee-laws-no-use-it-or-lose-it-vacation.aspx?Redirected=true. Accessed December 26, 2017.

8. U.S. Equal Employment Opportunity Commission, Compliance Manual, https://www.eeoc.gov/policy/docs/threshold.html#2-III-A. Accessed Nov. 8, 2017.

9. See Internal Revenue Service, Independent Contractor (Self-Employed) or Employee? https://www.irs.gov/businesses/small-businesses-self-employed/independent-contractor-self-employed-or-employee. Accessed December 26, 2017.

10. U.S. Department of Labor Fact Sheet, https://www.dol.gov/whd/overtime/fs17a_overview.pdf. Accessed December 26, 2017.

11. Section 13(a)(1) of the Fair Labor Standards Act as defined by Regulations, 29 CFR Part 541. https://www.dol.gov/whd/overtime/regulations.pdf. Accessed December 26, 2017.