Editor’s intro

When extending credit to patients, Truth-in-Lending Statements can provide an added level of protection. Dr. Laurance Jerrold offers helpful information on different lending scenarios.

Dr. Laurance Jerrold discusses legal requirements that relate to extending credit to patients

Because of the nature of orthodontic practice, the fact that it is expensive and extends on average for upwards of 2 years, we have, as part of our practice management strategy, designed payment plans to enable patients to meet their financial obligations. Legally, this is viewed as extending credit. Therefore, we are required to follow certain legal requirements that relate to the extension of credit to our orthodontic consumers. These consumers must be apprised of any finance charges or interest charged on the “loan” we are extending (our payment plan). In addition, we often charge the patient additional fees for such things as expenses incurred relating to the collection of past due accounts, including legal fees, fees for returned checks, late payment fees, fees for lost or excessive breakage of appliances, missed appointment fees, etc. Traditionally, this responsibility was handled through the use of a contract letter. Recently, this intra-office communications tool has been supplanted by using a Truth-in-Lending Statement. This article deals with how to design and use Truth-in-Lending Statements.

What is a Truth-in-Lending form, and why should orthodontists want to use one?

This is a common question and the answer lies in Regulation Z of the Consumer Credit Reporting Act. This Act requires all sellers of goods or services to provide the consumer of that product or service with a type of financial informed consent that in essence discloses the terms and the costs associated with the extension of any credit offered. The Act’s applicability to orthodontics lies in the fact that it must be utilized when businesses or individuals who are extending credit meet all of the following elements.

- Credit is offered. In our practices this is an everyday occurrence.

- The offering of credit is a regular part of doing business. Unless we have received payment in full up front, virtually all of our patients make their payments to us over time. This payment plan is in reality an extension of credit.

- The credit is subject to finance charges OR is payable by four or more installments excluding the down payment. This is almost universal to orthodontic practices.

- The credit is issued primarily for personal, family, or household This fits orthodontic practices like a glove.

There are several really good reasons to employ a Truth-in-Lending (T-in–L) Statement. First, the form itself is your contract with the patient. If you ever need to pursue legal action to collect your fee, this becomes the proof of the agreed-upon contract between you and the patient. Second, the T-in–L provides documented evidence of your contracts outstanding for the purposes of practice valuation. Third, the T-in–L is very useful in divorce or separation situations in that each parent should sign relative to his/her respective financial obligations.

The fourth, and arguably the best reason, is that if you don’t comply with the law, you are subject to a fine of $5,000 and/or a year in jail.

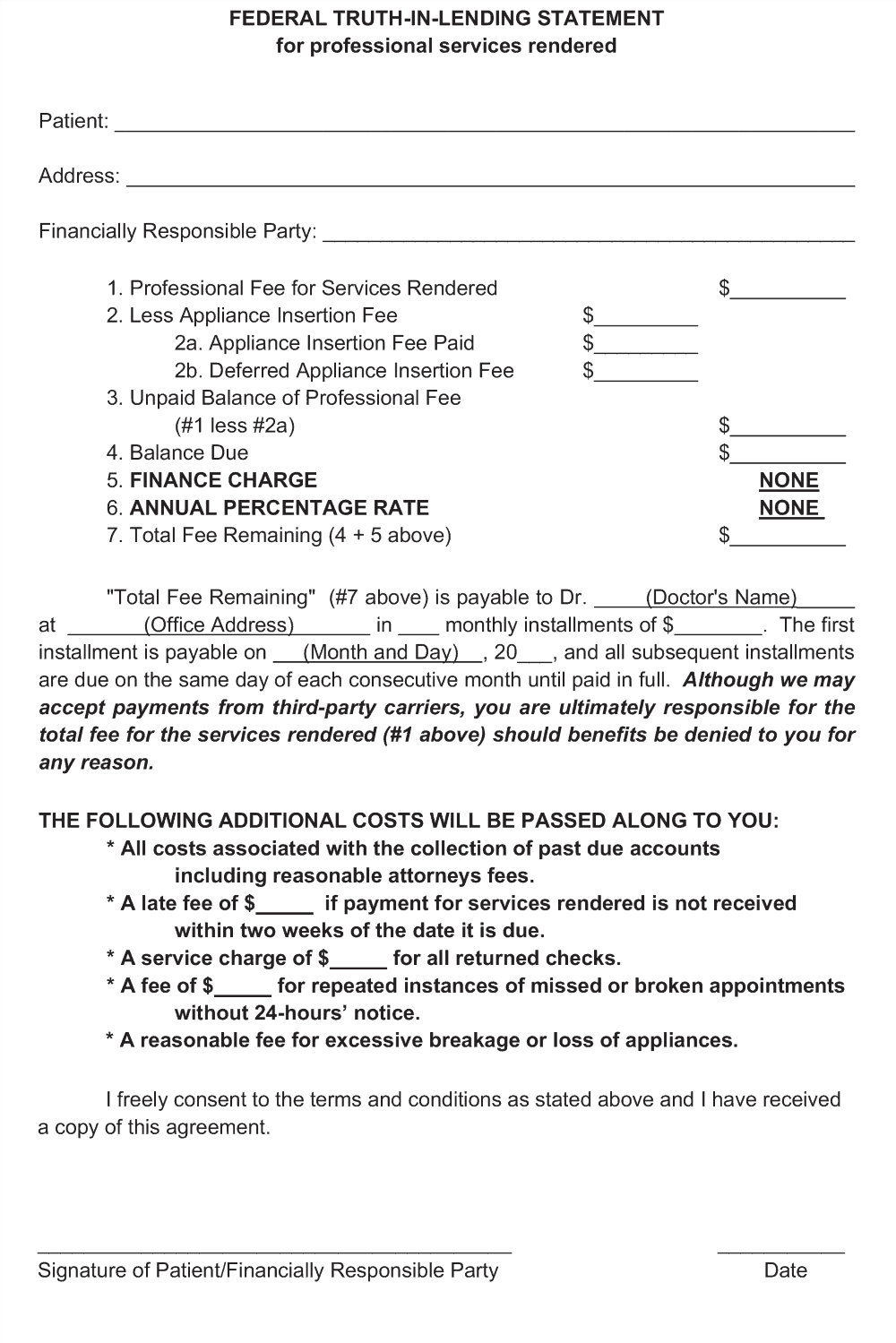

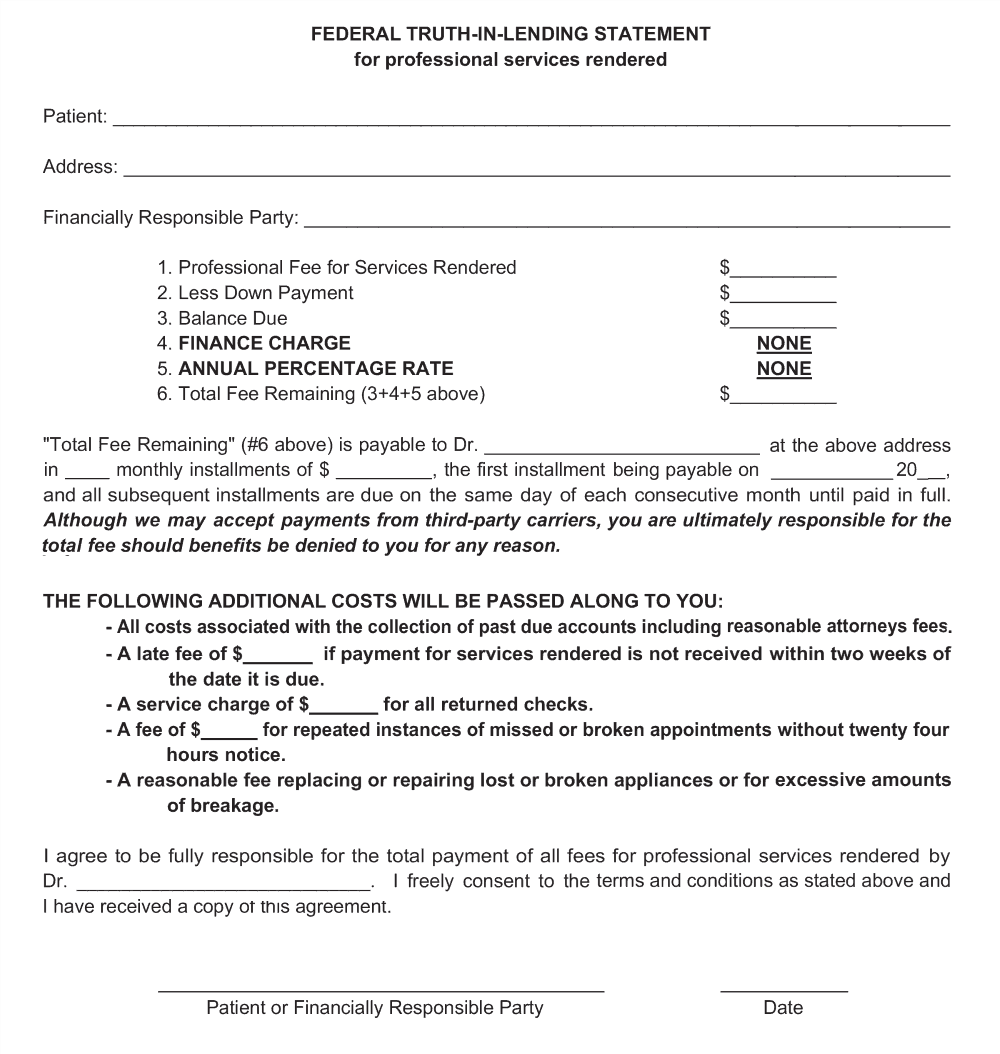

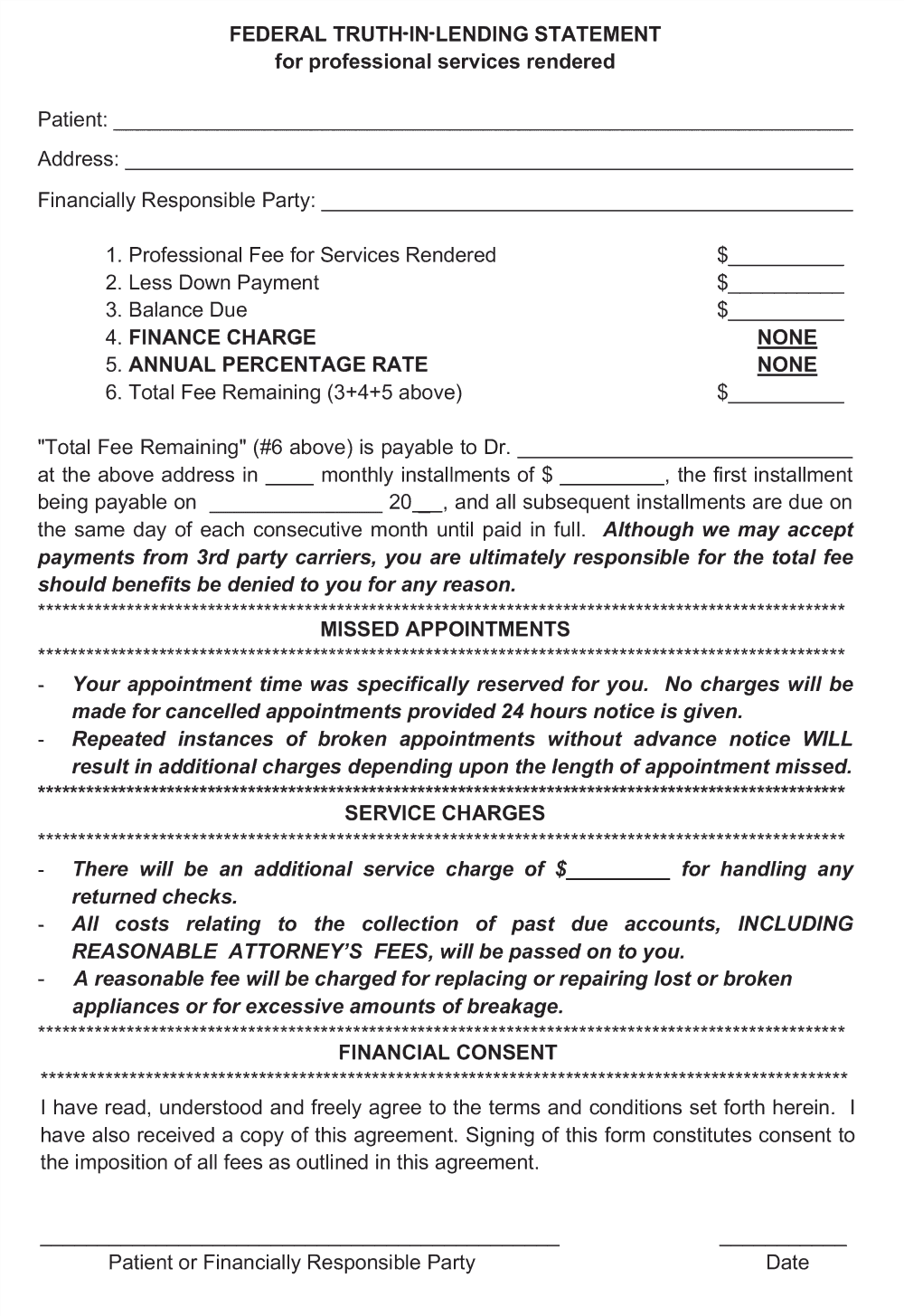

The figures in this article show different forms of Truth-in-Lending Statements. They all have as their core the information pertaining to finance charges, the interest rate, and the terms for payment. You can purchase preprinted forms from various companies or make your own. If you plan to levy any additional charges such as late fees, attorney’s fees, bank charges, etc., these must also be prominently specified in the T-in L Statement. As long as the annual percentage rate and finance charges are specified, you can mix and match the lower portion of the form. Feel free to copy these, or use them as a template to make your own.

Author’s note: This article is intended to provide general information and is not intended as legal advice. For legal guidance on specific situations, dentists should consult their attorneys.

What legal matters do you want to hear about from our advisory experts? Contact us by email, or visit our Facebook or LinkedIn, and we will try to address concerns that can reduce stress and help your business to thrive.

Editor’s call to action

Besides extending credit, Dr. Jerrold also has offered his expertise on informed consent. Read his article here.

https://orthopracticeus.com/ce-articles/consenting-adults-agreeing-whats-going-happen.

Stay Relevant With Orthodontic Practice US

Join our email list for CE courses and webinars, articles and mores