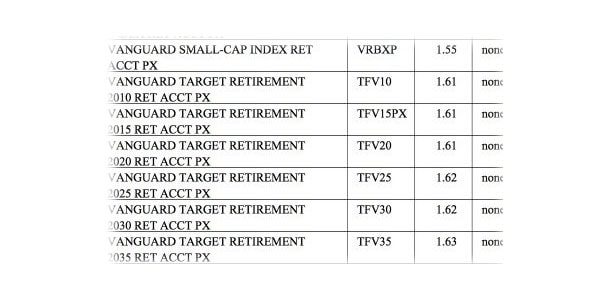

You might look at that picture above and scratch your head. Surely, if you know anything about Vanguard Funds, those expense ratios cannot be correct, could they? For those funds the expense ratios should be 0.16% or 0.17%…not 1.61%, right? I’m sure John Bogle, the founder of The Vanguard Group, if he saw it would be taken aback and say “who did this to our funds”?

You might look at that picture above and scratch your head. Surely, if you know anything about Vanguard Funds, those expense ratios cannot be correct, could they? For those funds the expense ratios should be 0.16% or 0.17%…not 1.61%, right? I’m sure John Bogle, the founder of The Vanguard Group, if he saw it would be taken aback and say “who did this to our funds”?

Someday, hopefully soon, we’ll all wake up in regards to our finances and how the financial services industry is truly robbing our ability to accumulate savings for a secure and dignified retirement. An article last week on Napa.net was titled, ” Most Clueless – or Worse – on Financial Product Costs”. The first line said “Most Americans believe they pay nothing for their financial products – or have no idea what they pay”.

That is certainly true. Over 60% of 401k plan participants believe they have no investment related fees. In the article noted above, 72% of a subset of the investors polled said they “pay nothing” for their investments!! Every day, plan sponsors tell us, when asked about the fees in their plan or those charged by their brokers or providers will say, ” I’m embarrassed to say I do not know”. And yet it’s THEIR money. Even worse, their employees, who had no say so in choosing the providers, can have their life savings, and their quality of life after active work decimated over time, and they never saw it coming.

Today, we received the fee disclosure pictured above from a Paychex plan, that is tied into their relationship with Transamerica. If there ever was a poster 401k plan to show why these companies should not be permitted to be in business, this is it. This employer had just signed up to start the first of this year, so this is not an “old Paychex offering”. No, it was sold to them at the end of 2015. Nowhere can it be more clear that these two companies think it is THEIR 401k plan, as opposed to who it actually is for, the participants in this plan.

In this case, Paychex and Transamerica have taken very a low cost index fund strategy used by hundreds of thousands of plan participants, and have mitigated the entire reason for doing so. These target date funds should have ACTUAL expense ratios of 0.16% to 0.18%, like noted here on our core fund list:

On these funds in the 401k plan that led me to write this post, Paychex is receiving 0.40% annually in revenue sharing via Transamerica. This means they are receiving 135% More in revenue sharing, than the Actual 0.17% cost of the fund!! Read Paychex’s annual report and you’ll see just how many millions they are making off unknowing plan sponsors via revenue sharing from the fund companies. But, they were hired as a recordkeeper, and their fee disclosures clearly state they are NOT a fiduciary to the plan. So…..why Do they get millions in compensation from plan assets?

On these funds in the 401k plan that led me to write this post, Paychex is receiving 0.40% annually in revenue sharing via Transamerica. This means they are receiving 135% More in revenue sharing, than the Actual 0.17% cost of the fund!! Read Paychex’s annual report and you’ll see just how many millions they are making off unknowing plan sponsors via revenue sharing from the fund companies. But, they were hired as a recordkeeper, and their fee disclosures clearly state they are NOT a fiduciary to the plan. So…..why Do they get millions in compensation from plan assets?

How can what Paychex and Transamerica are doing here be possible. How can the participants in this plan be forced to have a cost 847% More, for the SAME funds!!! Because we let them get away with it, we don’t dig into the math of things, to see their effect over time. We let some broker or payroll rep tell us, both butchers, not dietitians, that all is good. “I’ll take care of you, this is the best plan for you”, they say. Or, it’s as if the benefit of integration with payroll somehow glosses over how bad the plan actually is.

In any scenario of any aspect of your life, where would you of your own volition, pay 847% More for the Same thing? Why would you even pay 50% or 100% more, for the same thing? You would never do it, but in our 401k plans, where the well intentioned employer, too busy running their business, just did not dig deep enough and does not know their real costs, and their employees know even less, this happens more often than not. We see proof of it every day, via the 1000’s of 408b2 fee disclosures plan sponsors have sent us for review. It stunning, it’s sad, but thankfully it can be fixed.

Are all their plans like this? No, they are not thankfully, however we have hundreds of fee disclosures that are not much different than the plan being discussed. We literally receive disclosures every day, from payroll provider and broker/insurance company plans just robbing the savings of participants over time.

I am hopeful that if you read this and are a plan sponsor, you’ll take an hour to review your fee disclosure document word for word, number by number. Or send it to us by uploading it to the form on this page: https://americasbest401k.com/medmark/ if you don’t have the time or trained eye to do so, and we’ll provide a thorough analysis for you at no cost or obligation.

I am hopeful if you know anyone with a 401k plan, a family member, a friend, a client, you encourage them to do the same.

I am hopeful, that if you compete against the Paychex and ADP’s of the world, you join us to help render their model and services obsolete. I’m hopeful if your plan is with a broker/insurance company model you’ll dig into your plan to see that it’s all about them, and their pockets are being lined at your expense as a result of investment choices with needless and expensive fees.

I am hopeful, that rather an article being titled, “Most are clueless -or worse – regarding financial products costs, we’ll see an article titled……”Business owners and 401k plan participants woke the hell up and took control of their finances, understood the effect of fees, broke up with providers who were self serving, and had their retirement savings rescued with the help of companies like America’s Best 401k.

Stay Relevant With Orthodontic Practice US

Join our email list for CE courses and webinars, articles and mores

Tom Zgainer and his team have helped nearly 3500 companies obtain a new or improved retirement plan over the past 13 years. An expert in retirement plans designed to meet corporate and individual objectives, Tom and his company have a simple mission: To work with businesses small and large to rescue the retirement savings of American’s from plans with high, unreasonable, and excessive fees. You can learn more at

Tom Zgainer and his team have helped nearly 3500 companies obtain a new or improved retirement plan over the past 13 years. An expert in retirement plans designed to meet corporate and individual objectives, Tom and his company have a simple mission: To work with businesses small and large to rescue the retirement savings of American’s from plans with high, unreasonable, and excessive fees. You can learn more at