Justin Maxwell shows how a well-planned tax strategy by a knowledgeable niche-based team can save you money at tax time.

Justin Maxwell offers suggestions for maximizing your tax strategy

Justin Maxwell offers suggestions for maximizing your tax strategy

Senators, CPAs, and tax attorneys have long stated that most American small business owners pay more tax than is legally required. In fact, as a successful orthodontist, you have probably felt that you pay too much to the government in taxes. An independent study proved them right — they found that per $250,000 of income the average American business owner will pay about $11,000 more per year than is legally required in taxes.

Over 20 years, that’s an additional $220,000 paid to the government on top of what you are already paying them, and 100% of it is unnecessary. Fortunately, this problem is fixable, and there is a way to legally and ethically pay less tax that doesn’t require you to become a tax attorney or spend hours and hours doing something outside of your genius. In this article, we will explore one simple fix that can drastically improve or eliminate any and all unnecessary tax payments.

Whenever new orthodontists begin their business journey, one consistently offered piece of advice is: “find a good CPA.” While this advice is something every orthodontist should follow, it lacks a critical component that leads to the overpayments mentioned above. Instead, the recommendation should be to find a good tax TEAM. This is the simple fix that every orthodontist can implement today. Find a tax team versus a tax person.

The tax code is a behemoth. When you include all supporting documents, it contains over 80,000 pages. Expecting one person or one company to be an expert in all the nuances and available options is a mistake that will result in paying more taxes than is legally required.

Who then should be on this accounting team, and what roles should each team member fill?

Tax filer

The tax filer is responsible for complying with the ever-changing tax rules and regulations. These team members will compile all of your data, help you report what was made to the IRS, and tell you how much you owe in taxes. They will help you understand what is the best entity to be set up under for your given situation. They may also assist in bookkeeping, audits, providing accurate numbers as to what is going on in your business, and being a valuable resource for tax advice.

Most people go to the “tax filer” to get their taxes done. While this team member is a vital component of the team, they should not be the only member of the team. The tax filer is what we call a tax historian, meaning they can take what has happened and tell you how it will be taxed, but unless this person is paired with a proactive tax planner, there will always be unnecessary tax payments.

Tax strategists

The tax strategists are the most often missed member of the team. These team members will be a combination of specialists, tax attorneys, and third-party administrators. However, to ensure your time is maximized, it will need to be spearheaded by one quarterbacking person or group. This quarterbacking person will bring all the needed players to the table. The tax strategist’s job is to provide quality, proactive strategy that accesses more of the tax code and focuses on lowering the tax bill. The tax filer and strategist work hand-in-hand. No decision moves forward without the consent of the other. When both parties work together, you get a tremendously powerful approach that results in using more of the tax code and paying less tax.

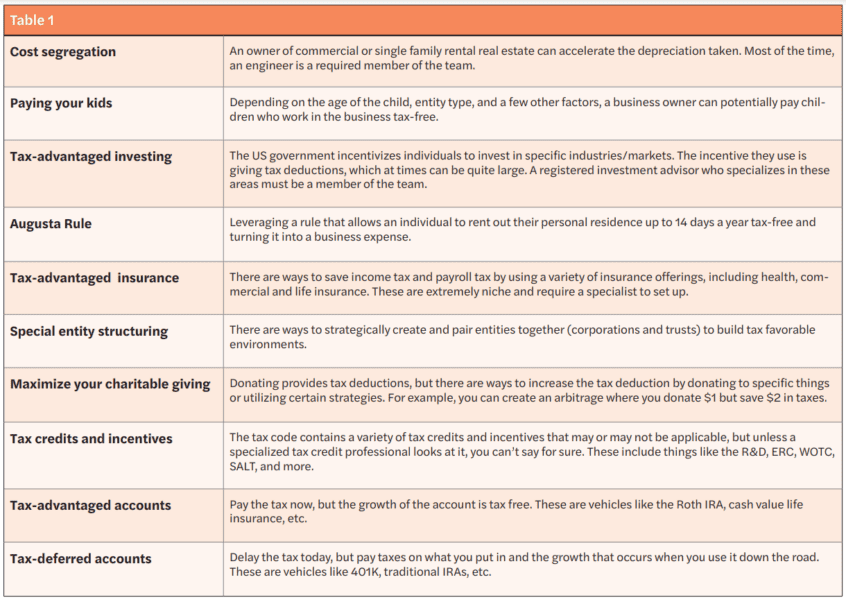

The tax strategist will help you as the business owner navigate through and implement the tax strategies that are most applicable to your situation. These include but are not limited to strategies found in Table 1.

If you were going through this table and thinking:

“My tax person tells me they do tax planning, but I’ve never had anyone talk to me about all these options, or why is that I have only had a conversation about one or two items on the list?”

Then it’s time for you to upgrade your team. When people hear that, they automatically assume they should dump their old accountant. But if you go and only hire a tax filer again, you will be in a very similar situation just with a new person. The simple fix is NOT hiring a new accountant; the simple fix is creating a tax team of both a tax filer and a tax strategist. This combination results in you having the best chance of reducing your tax bill to its legal minimum.

One of the biggest problems is that most people don’t even realize that an accounting team is something they are entitled to and that these tax savings options actually exist. Yet, throughout this article, we discovered that most business owners pay more taxes than is legally required, that there is a difference between a tax filer and a tax strategist, and that there are many more legal ways to pay less tax. Most importantly, we realized that the solution is not nearly as complicated as we think it should be. The simple fix is to create a tax team filled with both tax filers and tax strategists. When action is taken on this solution, you will find your tax bill goes down.

After reading about how to improve your tax strategy, check out how to add a level of protection for your lending strategies. Dr. Laurence Jerrold shares his thoughts in “Using a Truth-in-Lending Statement in clinical orthodontic practice” at https://orthopracticeus.com/using-a-truth-in-lending-statement-in-clinical-orthodontic-practice/

Stay Relevant With Orthodontic Practice US

Join our email list for CE courses and webinars, articles and mores

Justin Maxwell offers suggestions for maximizing your tax strategy

Justin Maxwell offers suggestions for maximizing your tax strategy Justin Maxwell is a wealth and tax strategist at Big Life Financial. He received a Master of Science degree from the University of Utah. He and his business partner join forces with dental and medical professional accounting teams across the country to help professionals implement effective business strategies. He can be reached at justinm@biglifefinancial.com.

Justin Maxwell is a wealth and tax strategist at Big Life Financial. He received a Master of Science degree from the University of Utah. He and his business partner join forces with dental and medical professional accounting teams across the country to help professionals implement effective business strategies. He can be reached at justinm@biglifefinancial.com.